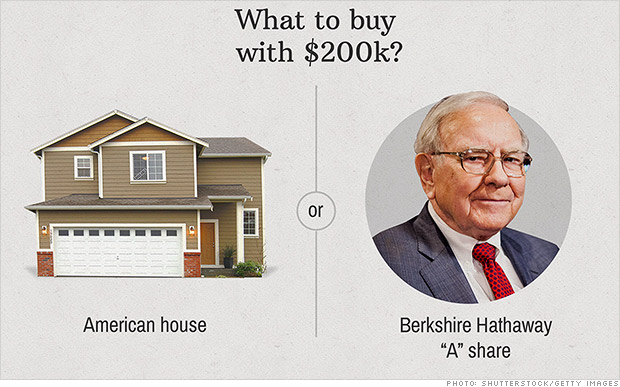

Warren Buffet is the Chairman, President and CEO of Berkshire Hathaway. For the first time, Berkshire Hathaway share (BRKA) has topped $200K. The cost of Berkshire Hathaway stock has now become almost the same as the median home in USA. Buying Berkshire stock is essentially a bet on the 83 year-old Buffett himself. He is heralded as a demi-god in the investment world. The scene at the annual Berkshire Hathaway Investor Day in May resembles a rock concert or state fair with tens of thousands of people, and someone paid $2.2 million in a charity auction for a lunch with Buffett.

Is it good news or bad news? Some think that this is a bad news for stocks including Dana Lyons, Yahoo Finance Contributor. This is what Dana Lyons says: “Sounds crazy, I know — that a stock breaking out might be sending a bearish signal for the stock market. It probably sounds particularly heretical on a day that Berkshire Hathaway A shares cross above $200,000 for the first time. It does make some intuitive sense, however, particularly considering this is not your everyday stock we’re talking about….”

According to Wikipedia… Berkshire Hathaway Inc. is an American multinational conglomerate holding company headquartered in Omaha, Nebraska, United States, that oversees and manages a number of subsidiary companies. The company wholly owns GEICO, BNSF, Lubrizol, Dairy Queen, Fruit of the Loom, Helzberg Diamonds, FlightSafety International, and NetJets, owns half of Heinz and an undisclosed percentage of Mars, Incorporated, and has significant minority holdings in American Express, The Coca-Cola Company, Wells Fargo, and IBM. Berkshire Hathaway averaged an annual growth in book value of 19.7% to its shareholders for the last 49 years (compared to 9.8% from the S&P 500 with dividends included for the same period), while employing large amounts of capital, and minimal debt…

This is something interesting. In 2010, Buffett claimed that purchasing Berkshire Hathaway was the biggest investment mistake he had ever made, and claimed that it had denied him compounded investment returns of about $200 billion over the subsequent 45 years. Buffett claimed that had he invested that money directly in insurance businesses instead of buying out Berkshire Hathaway (due to what he perceived as a slight by an individual), those investments would have paid off several hundredfold.