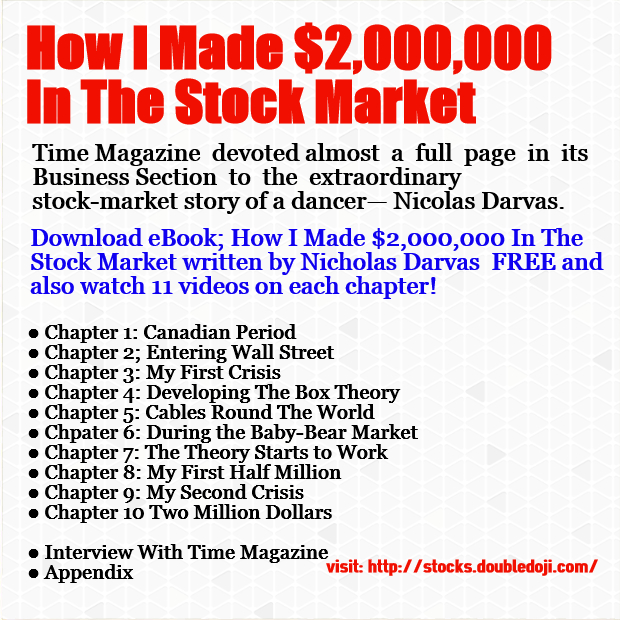

We had written a post on How I Made $2,000,000 In The Stock Market a few months back. This is the story of Nicholas Darvas a ballet dancer and an amateur part time stock trader who succeeded in making $2,000,000 in the stock market. This is a great story that happened in early 1960s. If you are a stock trader and you haven’t heard of Nicholas Darvas than you should download Nicholas Darvas eBook: “How I Made $2,000,000 In The Stock Market” FREE just now and go through this 127 page PDF today. In his book he explains in detail how he did it. Remember in 1960s there was no internet and buy/sell orders usually got placed on the phone. Nicholas Darvas was a professional ballet dancer who would sometimes go on foreign tours. Once he went to Nepal where there was no phone and a for a few weeks he was cutoff from contacting his broker at Wall Street. When you read the eBook, you will know all these stories from Darvas himself and how he failed in the beginning but then found success with his ingenuous box trading method.

Nicholas Darvas 11 Video Case Study

Nicholas Darvas story appeared in the Time Magazine’s business section in 1959. It was a great feat then and it is a great feat now. In today’s money 1960s $2 million is equal to $20 million. So you can well imagine how much money he had actually made. Now Dr. Scott Brown a finance professor has also made 11 videos on Nicholas Darvas as a case study that you should watch.

Canadian Period

Canadian Period starts in 1952 when Darvas gets paid in stocks instead of money. In the video below Dr. Scott Brown discusses Nicholas Darvas Canadian Period that you can also read as Chapter 1.

https://www.youtube.com/watch?v=O4uaeGNmkKE

Entering Wall Street

Darvas decides to start dabbling in stock trading and make his initial forays in stock trading when he opens a brokerage account by making the initial deposit. This is a video on Chapter 2 of the book titled: “Entering Wall Street”. You can read the chapter in the book that you downloaded just above and after reading this chapter you can watch this video commentary on the chapter by Dr. Scott Brown.

https://www.youtube.com/watch?v=tCrD3eVZ2wg&index=2

My First Crisis

Darvas has no deep understanding on how to trade stocks. In the beginning he is a novice just like you and me. He starts his stock trading career by watching the stock market on a daily basis and musing on what is happening to the different stocks. He gets a frightening experience when he invests in a few stocks and suffers a loss.

Reading the eBook chapter by chapter and after reading each chapter watching the video commentary on that chapter by Dr. Scott Brown is going to making many things clear to you. You have to relate yourself somehow to the different times that he lived in. As said in the beginning of the post those were the days there was no internet and most of the buy/sell orders were placed on the phone. Below is the video commentary on Chapter 3: My First Crisis.

https://www.youtube.com/watch?v=ryZBWgjMdFE

Developing The Box Theory

After his frightening experience in which he losses in one stock, Darvas sits down and studies the market seriously in an attempt to become a successful operator. Below is a very important video that will clear concepts on book Chapter 4: Developing The Box Theory. Box Theory is what made him successful. You should first read the chapter and then watch the video commentary below and if you don’t understand some concepts you can watch it a few times more. Just make sure that you understand the box theory. This was the pattern that turned Darvas from an unsuccessful stock trader to a successful stock trader.

https://www.youtube.com/watch?v=62pzn0QtEAM

Cables Around The World

In this chapter Darvas talks about the cables around the world. After reading Chapter 5: Cables Around The World, you can watch the video commentary below. As said above, in those days buy/sell orders used to get placed on the phone. But then keep in mind phone service was very expensive in those days with rates like $5/minute. So Darvas solved this problem by using cables. He told his broker to cable him everyday the daily quotes of stocks that were of interest. Each day he would receive a cable from his broker with stocks and their open, high, low and close of the previous day. In the night Darvas would work on the stock list and send reply cable to his broker with his orders. There was a special code that Darvas devised that helped him send the telegrams with low cost.

https://www.youtube.com/watch?v=7xdtWBN7rqw

During The Baby-Bear Market

Darvas views himself as an athlete preparing for the Olympics. He rehearses his strategy and prepares himself for the real event. This is the video commentary on Chapter 6: During The Baby-Bear Market.

https://www.youtube.com/watch?v=kJwRzaOU4EI

Theory Starts To Work

Darvas thinks of himself as a boxer who is looking for a opening to hit at the market. His theory starts to work and he gets the opening to hit back at the market. Below is the video commentary on Chapter 7; The Theory Starts To Work.

https://www.youtube.com/watch?v=QOdQCPkqSzg

My First Half Million

His box theory works and he makes his first half million in the stock market. This is happiest moment of his life and he doesn’t know which way to turn. He withdraws half of his profits. Below is the video commentary on Chapter 8: My First Half Million.

https://www.youtube.com/watch?v=RezBtrHm6Lg

My Second Crisis

He makes half a million in the stock market. This gives him tremendous confidence and he knows now that he can repeat the feat. He has no doubts now that he has mastered the art of stock trading and developed the sixth sense to make wins after wins. Just by looking at the stocks he knows whether to buy it or not. This overconfidence takes him to his second crisis. Below is the video commentary on Chapter 9: My Second Crisis.

https://www.youtube.com/watch?v=AsjWn0-APJU

Two Million Dollars

He learns how to overcome bouts of foolishness and starts to invests in stocks again. He succeeds and makes $2 million this time. Below is the video commentary on Chapter 10: Two Million Dollars.

https://www.youtube.com/watch?v=U9FrILAIdoE&index=10

Appendix: Charts

Looking at charts and knowing whether to buy or sell is what stock trading is all about. Below is video commentary on the book’s Appendix; Charts.

https://www.youtube.com/watch?v=RukwZEUoRZs

Now that you have read the book and watched the 11 videos, you must be feeling inspired. Well this story is indeed inspirational and the case study was meant to drive home the point that there is always a method to your madness. If you want to succeed you should be determined and persistence and you should develop an edge to beat the market. Darvas got the edge when he developed his box theory. In the beginning he tested it with small trades and once he was convinced that he has a solid method he then increased the size of this trades. Another great stock trading legend was W.D Gann. You can also read the post on How W. D Gann became a legend stocks and commodity trader. Nicholas Darvas has been our all time favorite. Reading his book and watching the above videos will help you make the journey with Nicholas Darvas on his quest to become a successful stock trader.